In a bold move to safeguard the dominance of the U.S. dollar, President-elect Donald Trump has announced plans for a staggering 100% tariff on goods from BRICS countries should they proceed with plans to move away from using the U.S. dollar or attempt to establish a new currency. This declaration was made on his social media platform, Truth Social, on November 30, 2024, signaling a hardline approach to international trade and finance as he prepares to assume office.

Trump’s message was clear: “The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER.” He demands that BRICS nations provide a formal pledge not to undermine the dollar’s status, warning that any country looking to replace it “should expect to say goodbye to selling into the wonderful U.S. Economy.”

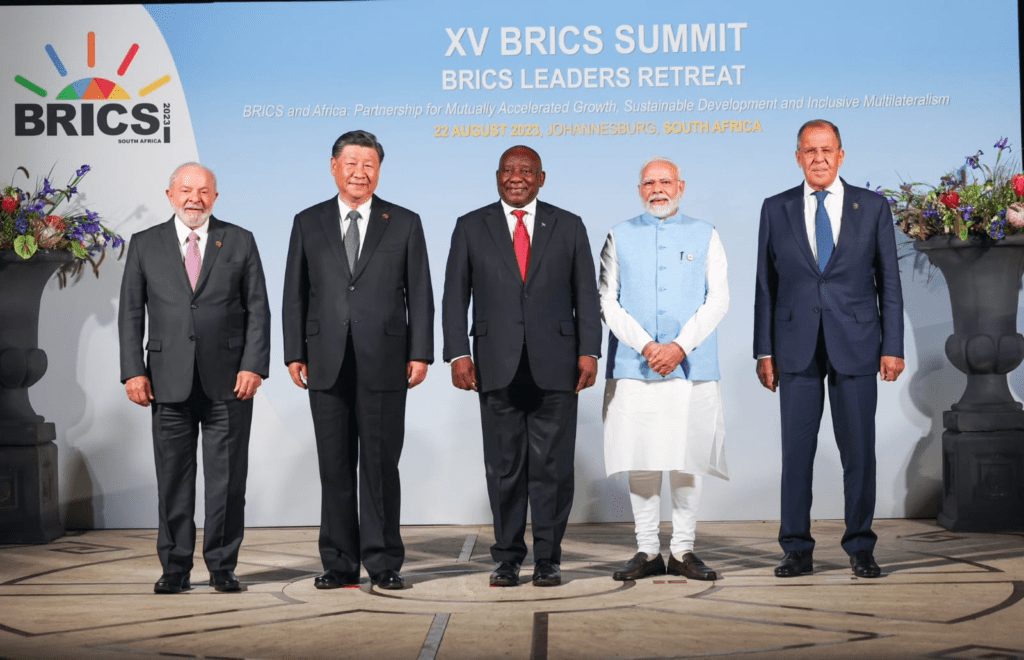

The BRICS alliance, which includes Brazil, Russia, India, China, South Africa, and has recently expanded to include countries like Iran, Egypt, Ethiopia, and the United Arab Emirates, has been exploring ways to reduce their dependency on the U.S. dollar. Discussions have included the potential creation of a “BRICS Currency” to challenge the dollar’s role in global trade.

This tariff threat is part of Trump’s strategy to maintain the U.S. dollar’s position as the world’s primary reserve currency. However, experts suggest that such aggressive posturing could inadvertently push BRICS countries to expedite their de-dollarization efforts. The global economic community is watching closely as this could lead to significant shifts in international trade practices and the financial landscape.

The implications of Trump’s policy could be far-reaching, potentially leading to increased trade barriers, shifts in global economic alliances, and a reevaluation of currency strategies among emerging markets. As the world watches, the dynamics between the U.S. and BRICS will likely shape the future of global economic interactions.