Tanzania has introduced fresh tariffs on various Kenyan goods, including meat, dairy, eggs, and confectionery products, a move that is straining trade relations between the two countries.

The new levies, which Kenyan manufacturers describe as “discriminatory,” have led to a significant decline in export revenues, impacting traders and producers.

According to industry reports, Kenyan exports to Tanzania dropped by KSh 4.2 billion last year, marking the first notable decline in nearly a decade, excluding the COVID-19 period in 2020.

The tax measures, seen as protectionist, are also viewed as a violation of the East African Community (EAC) Customs Union agreement, which promotes free trade among member states.

Kenyan Goods Face Steep Levies

Among the affected products is confectionery, where Tanzania now imposes a sugar levy of TSh 1,000 (approximately KSh 48.74) per kilogramme on chocolates, cookies, and candies originating from Kenya.

In contrast, locally produced alternatives are exempt from this tax, putting Kenyan manufacturers at a disadvantage.

Similarly, dairy products such as yoghurt, ice cream, cheese, and butter face a levy of TSh 1,000 per kilogramme or litre—an amount nearly 19 times higher than the TSh 50 (KSh 2.44) imposed on similar Tanzanian products.

Additionally, the Kenya Association of Manufacturers (KAM) revealed that Tanzania has imposed a 25 percent excise tax on hatching eggs imported from Kenya, a move that contradicts the principles of the EAC Customs Union.

The association criticized the tariffs, arguing that they make Kenyan goods more expensive than those available to Tanzanian consumers.

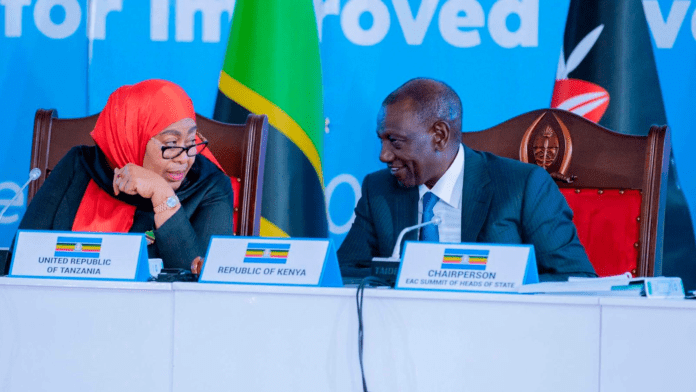

EAC Trade Protocol Under Scrutiny

The EAC Customs Union Protocol, established in 2005, was meant to facilitate seamless trade by eliminating duties on goods and services exchanged within the bloc. It also ensures free movement of money, labor, and products among member states. However, with the recent imposition of trade restrictions, Kenyan traders are struggling to maintain their foothold in the Tanzanian market.

Data from the Kenya National Bureau of Statistics (KNBS) shows that exports to Tanzania declined from KSh 55.96 billion in 2023 to KSh 51.84 billion in 2024, representing a 7.36 percent drop.

The appreciation of the Kenyan shilling against regional currencies has further compounded the challenge for exporters.

Manufacturers Threaten Relocation

Earlier reports indicated that some Kenyan manufacturers have considered shifting operations to Tanzania and Uganda, citing high production costs and restrictive tax policies at home.

KAM’s Chief Operating Officer, Tobias Alando, noted that for many businesses, it is now more cost-effective to manufacture and sell goods in Tanzania or Uganda rather than in Kenya. Sectors such as steel and cement have already sounded the alarm, with some companies threatening to move operations unless the situation improves.

The growing trade tensions between Kenya and Tanzania highlight ongoing challenges in regional integration, with business leaders urging both governments to engage in diplomatic talks to resolve the issue and restore smooth trade relations.