Kenya’s gross public debt has continued to decrease, reflecting the economy’s resilience despite facing both domestic and external challenges.

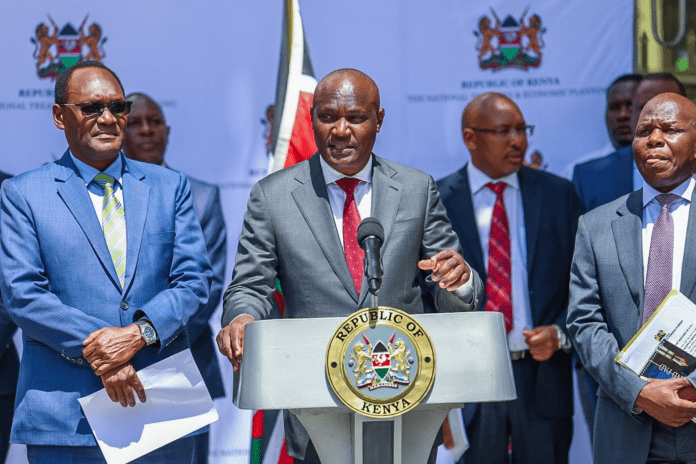

Treasury Cabinet Secretary John Mbadi announced that the gross public debt-to-GDP ratio dropped from 71.9 percent in June 2022 to 66.7 percent in June 2024. He credited this achievement to tax policy adjustments, spending cuts, and efforts to stimulate various economic sectors. The CS highlighted that the country’s diversified economy and sound government policies were key drivers behind this improvement.

“The present value of the debt-to-GDP ratio fell from 68.7 percent in 2023 to 63.0 percent in 2024, thanks to exchange rate appreciation and fiscal consolidation,” Mbadi said. He added that macroeconomic indicators continue to show the economy’s resilience, particularly in the external sector.

The Central Bank of Kenya (CBK) has also eased monetary policy. The Central Bank Rate (CBR) was reduced from 13 percent in August 2024 to 10.75 percent in February 2025. Additionally, the Cash Reserve Ratio (CRR) was lowered by 100 basis points to 3.25 percent in February 2025, aiming to boost private-sector credit growth.

Interest rates have also declined, with the interbank rate falling from 13.7 percent in January 2024 to 11.2 percent by January 2025. Treasury bill rates also dropped, with the 91-day rate falling to 9.11 percent in February 2025 from 16.1 percent a year earlier.

Mbadi emphasized that the easing of monetary policy had led to a recovery in private-sector credit, with major banks reducing lending rates. For instance, Cooperative Bank cut its base lending rate from 16.5 percent to 14.5 percent, KCB from 15.6 percent to 14.6 percent, and Equity Bank from 17.3 percent to 14.3 percent. Other banks, including ABSA and NCBA, are expected to follow suit.

Inflation has significantly decreased, from 9.6 percent in October 2022 to 3.3 percent in January 2025, largely due to government interventions in food and energy prices. Additionally, tax law amendments introduced in late 2024 have eased the financial burden on Kenyan households, ensuring broader economic benefits.

However, the CS acknowledged that addressing pending bills remains a priority. Delays in payments have affected businesses, especially Micro, Small, and Medium Enterprises (MSMEs), and eroded public confidence in government financial management.

“The government remains committed to ensuring that economic gains translate into tangible benefits for all Kenyans,” Mbadi stated.

Dr. Chris Kiptoo, Principal Secretary for the National Treasury, noted that Kenya’s diversified economy has helped sustain a relatively high GDP growth rate. While global growth is around three percent and sub-Saharan Africa’s at 3.7 percent, Kenya’s GDP stands at approximately five percent.

“With continued stability and without additional shocks, we expect to maintain strong performance,” Kiptoo said, urging Kenyans to support the government’s efforts to create jobs and opportunities.