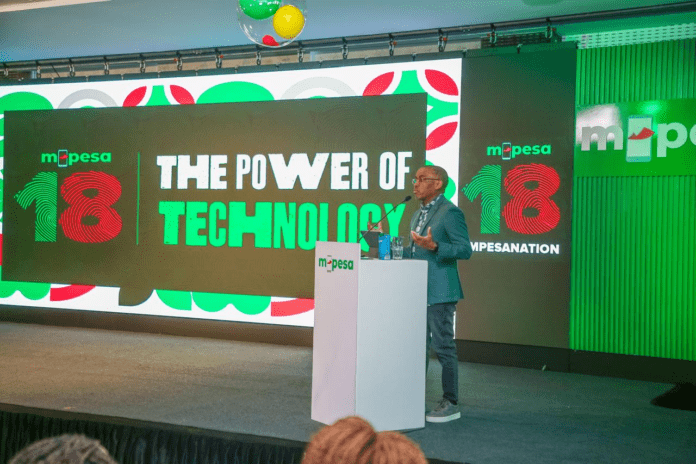

M-Pesa, Safaricom’s flagship mobile money service, is celebrating its 18th anniversary in March 2025, reflecting nearly two decades of growth from a simple payment solution to a comprehensive financial ecosystem.

Beyond facilitating transactions, the platform now offers a range of financial products, including credit, savings, investment options, insurance, and wealth management solutions.

By November 2024, Safaricom reported that M-Pesa had grown to serve 34 million customers, supported by a network of over 300,000 agents across Kenya.

Safaricom CEO Peter Ndegwa attributed this success to the company’s commitment to secure and seamless financial services.

“The rise in M-Pesa users underscores the trust and loyalty of our customers. We remain dedicated to innovation and delivering reliable financial solutions,” Ndegwa stated on December 5, 2024.

With 1.5 million businesses—ranging from small enterprises to large corporations—relying on M-Pesa, Safaricom continues to enhance its offerings to meet the evolving financial needs of individuals and businesses alike.

Key M-Pesa Financial Products Driving Expansion

Several key financial services have fueled M-Pesa’s expansion, contributing to the steady increase in customer numbers, which grew by 1.5% from 33.5 million in 2024.

1. Comprehensive Insurance (Bima)

In November 2024, Safaricom obtained an insurance intermediary license, enabling it to partner with insurers and introduce Bima, a comprehensive insurance product available via M-Pesa. The initiative is expected to accelerate insurance accessibility and adoption.

2. M-Pesa Ratiba – A Game-Changer for Bill Payments

Launched in October 2024, M-Pesa Ratiba became Kenya’s first mobile money standing order solution, allowing users to schedule automatic payments for bills and utilities. Within a month, over one million users had signed up, completing more than 260,000 transactions.

3. Investment Solutions – Ziidi & Mali Money Market Funds

To help customers grow their savings, Safaricom ventured into the money market space with Ziidi Money Market Fund (Ziidi MMF), approved by the Capital Markets Authority (CMA) in November 2024.

Additionally, Mali MMF, which was introduced in 2019, had accumulated assets worth KSh 3 billion by September 2024, reinforcing M-Pesa’s role in personal finance.

4. Credit Services – M-Shwari, KCB M-Pesa, and Fuliza

M-Pesa has provided credit solutions since 2007, with M-Shwari and KCB M-Pesa offering loan and savings services in partnership with NCBA and KCB Bank, respectively.

In 2019, Safaricom introduced Fuliza, an overdraft service that was later expanded to businesses in 2023, providing more financial flexibility to entrepreneurs.

5. Merchant Payment Solutions

M-Pesa’s business payment services, including Lipa Na M-Pesa, Buy Goods, Paybill, and Pochi la Biashara, have also seen significant adoption.

By March 2024, the total value of M-Pesa transactions had grown by 9.6% to KSh 40.24 trillion, with transaction volumes increasing by 33.9% to KSh 28.33 billion.

The number of Lipa Na M-Pesa active merchants rose to 633,010, while Pochi la Biashara accounts stood at 632,681.

M-Pesa’s Role in Safaricom’s Growth

M-Pesa remains a crucial revenue driver for Safaricom, contributing significantly to the company’s financial performance.

For the first half of the 2024/2025 financial year, Safaricom Kenya reported a net profit of KSh 47.5 billion, a 14.1% increase from the previous year. This growth was largely supported by rising M-Pesa transaction volumes and value.

As the platform marks 18 years, its evolution from a mobile payments service to a full-fledged financial ecosystem underscores its transformative impact on Kenya’s digital economy. Safaricom continues to explore new opportunities to expand its financial solutions and enhance accessibility for millions of users.

![SHA Suspends Dozens of Health Facilities Over Alleged Fraud [LIST]](https://citymirror.ke/wp-content/uploads/2024/12/image-14-218x150.png)