The Kenya Revenue Authority (KRA) has issued a fresh directive to betting and gaming companies seeking to renew their licenses for the 2025/26 financial year, outlining strict compliance requirements.

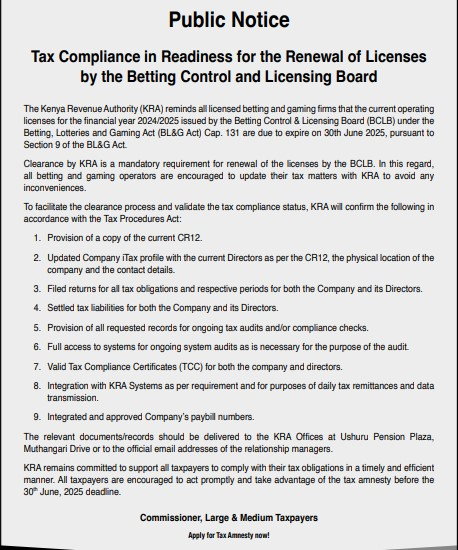

In a public notice published on Tuesday, May 6, KRA reminded all operators that their current licenses—granted by the Betting Control and Licensing Board (BCLB)—will lapse on June 30, 2025. Firms must therefore apply for renewal if they wish to continue operating.

“All betting and gaming operators licensed under the Betting, Lotteries and Gaming Act (Cap 131) are reminded that their licenses for the 2024/25 fiscal year will expire on June 30, 2025,” the statement read.

KRA emphasized that it will only clear firms that are fully tax-compliant. Without this clearance, license renewals by the BCLB will not be processed.

To qualify, companies must submit a valid CR12 form—an official document listing company shareholders and directors—and update their iTax profiles with current information, including accurate contact details and physical addresses.

The tax authority also stated that companies and their directors must have no outstanding tax liabilities and should have filed all required tax returns. In addition, all directors must possess valid Tax Compliance Certificates.

Firms under audit are expected to provide full access to their systems and records, and cooperate with ongoing investigations. Integration with KRA’s digital systems for tax remittance and data sharing is another non-negotiable condition. Betting firms must also provide verified and approved paybill numbers for transactions.

The renewed push for compliance follows recent regulatory crackdowns on rogue operators. BCLB recently blacklisted 58 betting websites for operating illegally, accusing them of exploiting users by taking deposits and failing to pay out winnings.

According to authorities, these sites pose a financial risk to unsuspecting users and undermine regulatory efforts to streamline the gaming industry.

KRA urged all stakeholders in the betting sector to regularize their tax affairs to avoid disruptions in their operations as the June deadline approaches.