A growing number of Kenyans are changing banks due to poor customer service, high fees, and unreliable mobile banking platforms, according to the Kenya Bankers Association (KBA) 2024 Customer Satisfaction Report.

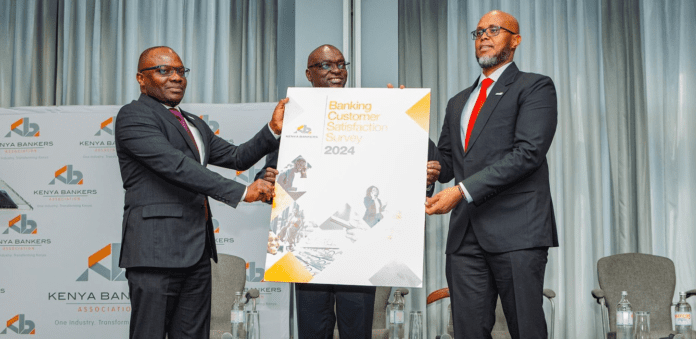

The report, released on Wednesday, also highlights that nearly half of bank account holders in Kenya maintain two or more accounts, reflecting increased competition in the financial sector as customers seek better banking experiences.

The findings indicate that forty-seven point three percent of respondents cited poor customer service as the primary reason for moving to another bank. Additionally, forty-six percent pointed to high transaction and maintenance fees as a major concern. Other factors influencing the shift include unreliable digital banking services, long wait times, and security challenges.

“Transparency in fees, strong complaint resolution systems, and financial literacy programs are essential. With only eighteen point three percent of Kenyans financially stable, banks need to invest in tools that promote financial wellness and responsible borrowing,” said Competition Authority of Kenya (CAK) Director-General David Kemei.

The report also underscores a shift toward digital banking, with mobile and internet banking emerging as the most preferred channels.

“More than fifty-six percent of customers prefer self-service digital platforms due to their convenience and accessibility,” the report states.

However, financial inclusion remains a challenge, especially in rural areas where banking services are concentrated in urban centers, limiting access for underserved populations.

Kenya National Chamber of Commerce and Industry (KNCCI) CEO Ahmed Farah emphasized the need for financial institutions to expand their reach beyond major cities.

“Micro, Small, and Medium Enterprises (MSMEs), which contribute forty percent of our GDP, still struggle to access affordable financial services. Expanding partnerships to enhance digital inclusion will empower small businesses and grassroots entrepreneurship,” he noted.

Farah also highlighted the role of artificial intelligence in advancing financial inclusion and improving banking efficiency.

Despite these challenges, customer loyalty in Kenya’s banking sector has shown signs of improvement. The industry’s Net Promoter Score (NPS), which measures customer satisfaction and likelihood of recommending a bank, rose from thirty-seven point seven percent in 2023 to forty-four percent in 2024. Additionally, fifty-eight point one percent of customers actively recommend their banks.

However, retention remains an issue, with only thirty-six point seven percent of customers sticking to one bank, while nearly half manage multiple accounts to compare service quality and cost-effectiveness.

Financial accessibility is another pressing concern, with ten point six three percent of customers requiring specialized accommodations, such as braille and screen readers. However, many digital banking platforms still lack these essential features.

Kenya Bankers Association CEO Raimond Molenje emphasized the importance of enhancing accessibility and digital security.

“Kenya’s banking sector is a leader in innovation, but operational gaps must be addressed to maintain public trust. Strengthening digital infrastructure and ensuring inclusivity—such as expanding our Persons with Disability Accessibility Project—will make banking services more secure, seamless, and accessible to all,” he stated.