The Neon Ultra and Neon Smarta, the first affordable smartphones assembled in Kenya, were launched with much fanfare through a collaboration between Jamii Telecom, Safaricom, and China’s Shenzhen TeleOne Technology at the East Africa Device Assembly Kenya Limited (EADAK) plant.

Touted as a breakthrough in making smartphones more accessible to Kenyans, the devices marked a milestone for the country’s manufacturing ambitions. However, recent data shows that the Neon brand is losing traction among consumers, even as smartphone penetration continues to rise nationwide.

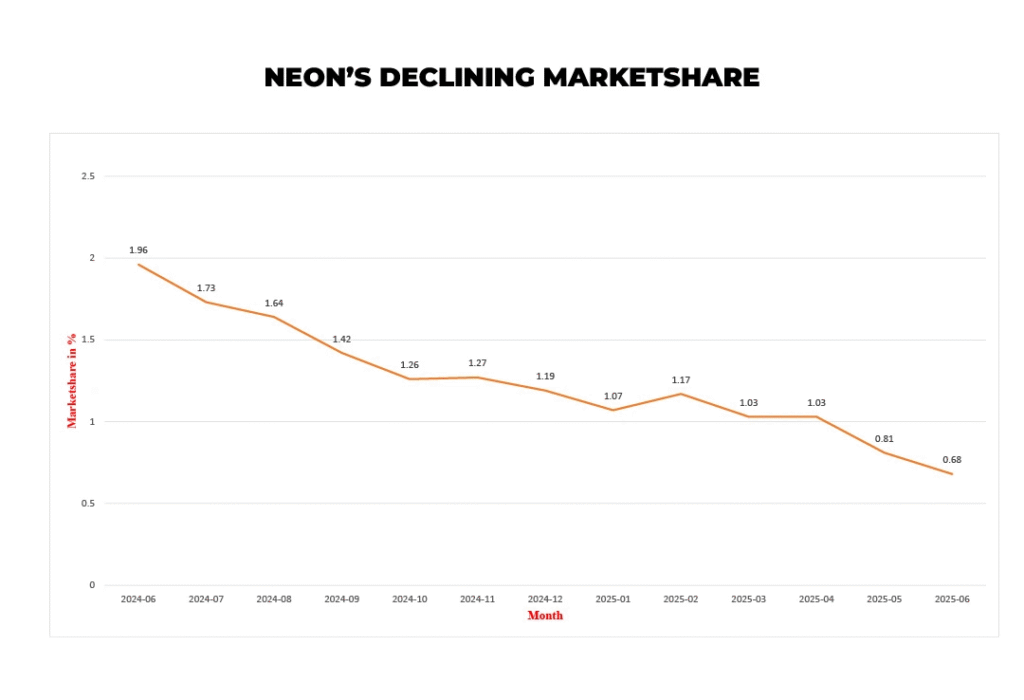

When President William Ruto officially unveiled the EADAK plant, the locally made Neon smartphones held a market share of 2.09%. But by June 2024, this figure had dropped to 1.96%, and a year later, it had plunged to just 0.68%, according to data from StatCounter.

This steady decline suggests that despite their affordability—initially retailing at KES 7,000 and KES 11,000—the Neon devices are struggling to stay competitive. As of July 2025, the Neon Ultra 2 is listed at KES 9,999 on Safaricom’s online store, Masoko.

The Neon brand is under pressure from global manufacturers offering better-performing smartphones at nearly the same price. Infinix, iTel, Redmi, and Vivo have all introduced devices with improved specs and user experience, eroding Neon’s appeal in the low-cost segment it was built to dominate.

Samsung Maintains Market Dominance

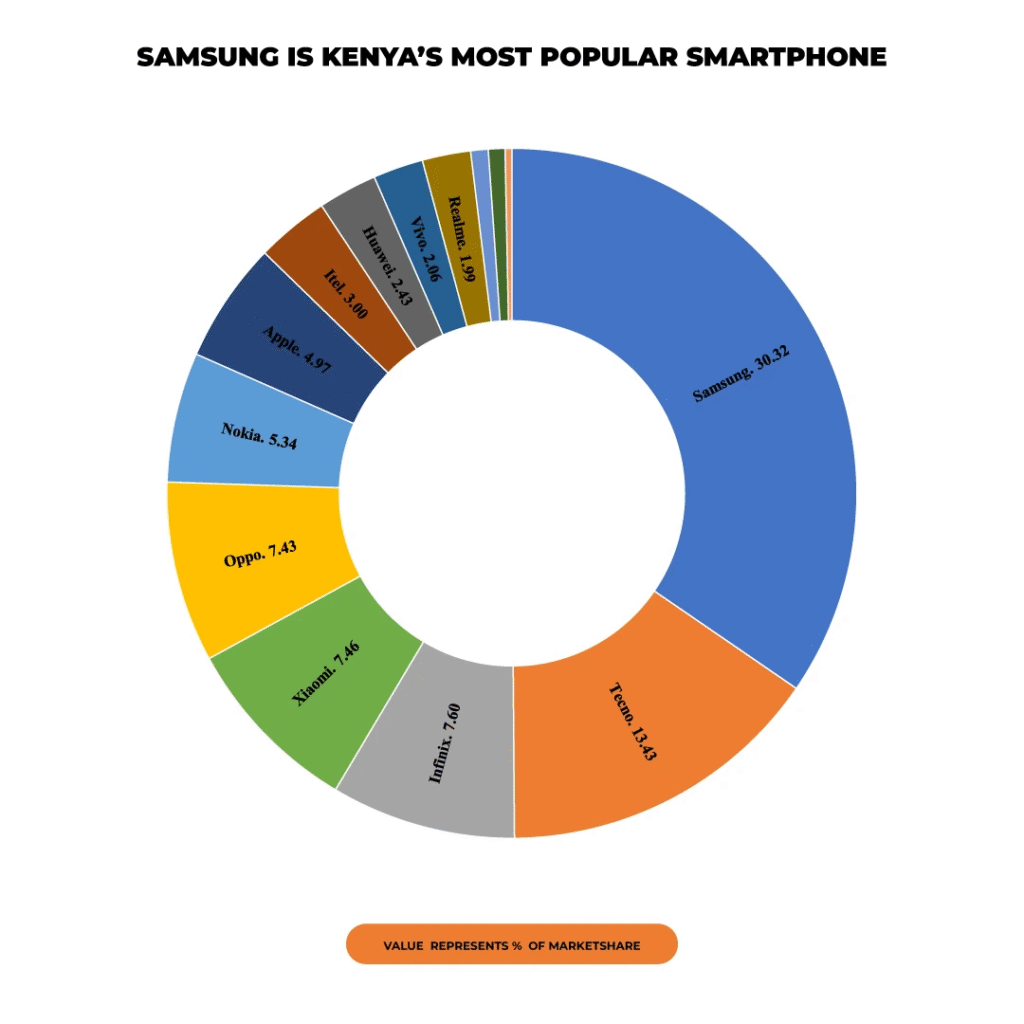

Meanwhile, Samsung remains Kenya’s most popular smartphone brand, growing its market share from 18.32% to 24.32% between June 2023 and June 2024. The South Korean tech giant continues to attract a wide range of consumers across different price brackets.

Chinese manufacturer Xiaomi also saw a notable rise, with its market share growing from 5.28% to 7.46%. Xiaomi sells smartphones under its main brand and the budget-friendly Redmi line, pushing it to fourth place in Kenya’s smartphone market—just ahead of Oppo, which holds 7.43%.

Mixed Results for Transsion Holdings

Transsion Holdings, which manufactures Infinix, TECNO, and iTel, posted mixed results. Infinix retained the third spot in the market with a steady 7.60% share, thanks to its consistent release of mid-range and entry-level models, such as the Note, Hot, and Smart series.

TECNO, however, saw its market share slip from 16.98% to 13.43%, while iTel’s dropped from 4.26% to 3%. Analysts attribute these declines to stiff competition in the entry-level smartphone space.

Apple Gains in Niche Segment

Even in a price-sensitive market, Apple’s iPhone made gains, increasing its market share from 4% to 4.97%. This growth allowed the premium brand to overtake iTel and claim the number 7 position, underscoring the demand for high-end devices among a niche segment of Kenyan consumers.

Wider Implications for Local Manufacturing

The shrinking market share of Neon smartphones raises questions about the long-term viability of local assembly initiatives if product performance and appeal cannot keep up with fast-moving global brands.

While the EADAK plant symbolised a major stride in Kenya’s push toward local industrialisation, the experience of Neon highlights the complex dynamics of consumer preference, global competition, and the importance of continuous product innovation.

Market share figures are based on StatCounter data, compiled from monthly visits to over 1.5 million websites and more than 5 billion page views globally.