In a significant financial shift, KCB Group has emerged as Kenya’s most profitable corporate group, surpassing Safaricom with a Profit After Tax (PAT) of KSh 61.8 billion in 2024. This milestone marks a major transformation in Kenya’s corporate landscape, driven by KCB’s strong revenue streams and strategic financial growth.

Key Factors Behind KCB’s Rise

KCB’s impressive performance can be attributed to:

- Robust Interest Income Growth – Increased earnings from loans and government securities played a pivotal role.

- Diversified Revenue Streams – Unlike Safaricom, which heavily relies on telecommunications, KCB’s expansion in banking and financial services has strengthened its profitability.

- Safaricom Ethiopia’s Challenges – The telco’s heavy investments in Ethiopia, coupled with operational costs, have affected its overall group performance.

While Safaricom Kenya remains the most profitable single entity, posting a PAT of KSh 82.65 billion, its group earnings declined to KSh 42.7 billion due to continued losses in Ethiopia.

Kenya’s Top Corporate Groups by Profitability (2024)

| Rank | Company | Group Profit After Tax (KSh Bn) |

|---|---|---|

| 1 | KCB Group | 61.8 |

| 2 | Equity Group | 48.8 |

| 3 | Safaricom Group | 42.7 |

| 4 | Kenya Power | 30.08 |

| 5 | Cooperative Bank | 25.46 |

| 6 | NCBA Group | 21.87 |

| 7 | ABSA Kenya | 20.88 |

KCB’s Record-Breaking Growth

KCB’s latest financial results highlight an impressive 65 percent rise in profits compared to 2023, reflecting its strategic focus on long-term sustainability.

- Profit After Tax: KSh 61.8 billion, a significant increase from KSh 40.8 billion in 2022.

- Net Interest Income: Jumped to KSh 137.4 billion, fueled by a 33.9 percent rise in non-funded income, which was boosted by a 62 percent increase in forex earnings.

- Revenue Drivers: Growth was propelled by a KSh 32 billion increase from loan interest, KSh 8 billion rise from government securities, and an overall operating income jump to KSh 204.9 billion from KSh 165.2 billion in 2023.

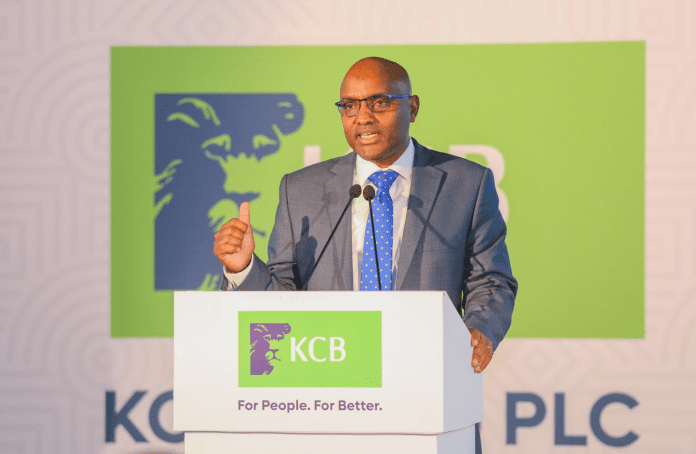

KCB Group CEO Paul Russo expressed confidence in the bank’s trajectory, stating:

“The strong performance illustrates our resolve over the past three years to build an organisation for the future that is anchored on delivering value for our customers, shareholders, and all stakeholders.”

Safaricom’s Standalone Strength vs. Group Struggles

While Safaricom Kenya remains a powerhouse, its overall group performance has been affected by its Ethiopia venture.

| Year | Safaricom Kenya PAT (KSh Bn) | Group PAT (KSh Bn) |

|---|---|---|

| 2020 | 73.3 | 73.66 |

| 2021 | 67.96 | 68.7 |

| 2022 | 71.78 | 67.5 |

| 2023 | 74.94 | 52.48 |

| 2024 | 82.65 | 42.66 |

Since acquiring a license to operate in Ethiopia in 2021, Safaricom’s group profits have steadily declined, despite growth in the Kenyan market. In 2024, this gap widened significantly—while Safaricom Kenya’s PAT rose to KSh 82.65 billion, the group PAT fell to KSh 42.66 billion, highlighting the impact of Ethiopian losses.

The Future of Kenya’s Corporate Giants

KCB’s dominance in 2024 signals a growing influence of the banking sector in Kenya’s corporate landscape, while Safaricom’s future will depend on how quickly it stabilizes operations in Ethiopia. As both companies navigate changing economic dynamics, their strategies will determine who holds the top spot in the years ahead.