Policy and industry experts have raised alarm over key provisions in the Finance Bill 2025, warning that the proposed tax measures could severely undermine Kenya’s manufacturing sector, business cash flow, and long-term investment outlook.

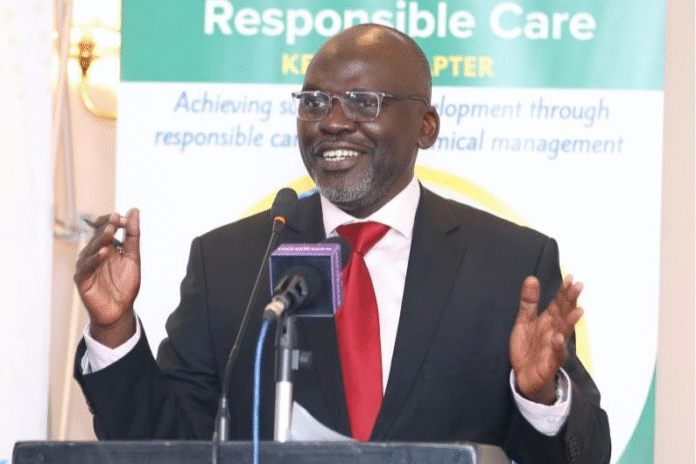

Among the most contentious proposals is the reclassification of certain products from zero-rated to tax-exempt — a move that experts say will increase the cost of basic goods. Kenya Association of Manufacturers (KAM) CEO Tobias Alando explained that without a refund mechanism for inputs, businesses will have no way to recover Value Added Tax (VAT) already paid, leading to higher consumer prices.

“The move to make products tax-exempt will increase their cost. And as long as Kenya does not have a mechanism to claim refunds on inputs, products will remain expensive,” Alando stated.

The bill also proposes an increase in excise duty on imported packaging materials from outside the East African Community (EAC), removal of the 15 per cent corporate tax incentive for local motor vehicle assemblers, and broader Kenya Revenue Authority (KRA) access to personal and business data for integration into its electronic tax system.

Alando warned that the increased excise duty could discourage local production and encourage the importation of finished plastic products, shifting jobs outside the country.

“Taxing inputs and raw materials is not helping the growth of the manufacturing sector,” he said, adding that the cost of duty payable for local production runs up to 60 per cent — significantly higher than the cost of importing finished goods.

The manufacturing sector, which employs over 369,000 people directly, continues to struggle with slow growth, made worse by unpredictable policy decisions. Alando noted that in the third quarter of last year, 60 per cent of manufacturers were holding back on investments as they awaited clarity on the Finance Bill.

“This proposal is likely to cripple the manufacturing sector and encourage importation,” he said, cautioning that policy makers may not fully grasp the economic impact of their decisions.

The Federation of Kenya Employers (FKE) also criticised the bill, particularly a proposal to extend the period for VAT refunds from 90 to 120 days, or up to 180 days in cases that require audits. FKE warned that such delays would significantly strain business liquidity.

Equally controversial is the proposed deletion of a provision in the Income Tax Act that allows companies to carry forward losses. FKE Executive Director Jacqueline Mugo argued that this contradicts basic taxation principles.

“This may discourage investment, distort financial positions, and create unfairness by taxing profits while ignoring losses, ultimately harming economic efficiency,” Mugo said.

The Federation also took issue with the proposed removal of a 15 per cent tax incentive for real estate developers constructing at least 100 residential units annually. Mugo said this change could derail investment in the housing sector.

Further, the imposition of VAT on goods meant for building and equipping specialised hospitals could increase healthcare infrastructure costs, deterring investors in a sector where the country already faces serious gaps.

Mugo said the broader perception among employers is that taxation in Kenya is too high, yet public services remain poor — leading to widespread frustration and a rise in the so-called “working poor.”

“The perception is that we are heavily taxed, yet the quality of public service delivery does not reflect this burden. Payroll taxation is leaving employees vulnerable,” she said.

Economist Patrick Muinde added that frequent changes in tax policy have created an unpredictable environment for long-term business planning.

“When you are in an environment where taxes change every year, you cannot project how they will behave over the next five years. The lack of predictability makes the business environment quite toxic,” Muinde said.

While the government has avoided direct income tax increases in the 2025-26 Budget, experts say the indirect tax measures will have far-reaching effects on household purchasing power and business sustainability.

Stakeholders are calling on lawmakers to reconsider the bill’s provisions and develop tax policies that promote industrial growth, encourage investment, and protect jobs — instead of imposing measures that stifle economic resilience.

![SHA Suspends Dozens of Health Facilities Over Alleged Fraud [LIST]](https://citymirror.ke/wp-content/uploads/2024/12/image-14-218x150.png)