The collapse of CBEX, a digital Ponzi scheme disguised as a crypto investment platform, has left investors across Africa counting losses exceeding US$840 million, according to Nigerian media reports.

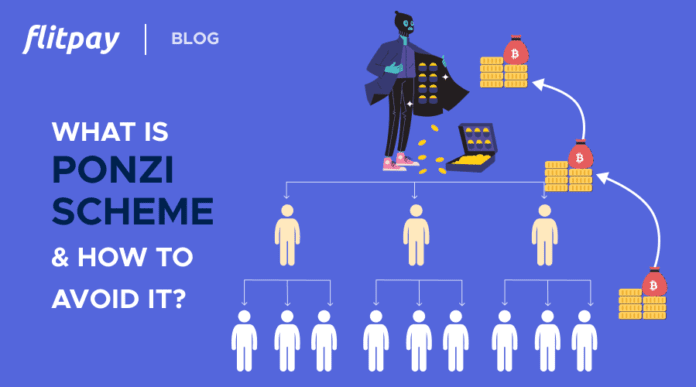

CBEX promised investors one hundred percent monthly returns through what it claimed was a crypto-powered trading platform. However, it operated by using new investors’ funds to pay earlier ones, a classic Ponzi structure. It also rewarded users for recruiting others, encouraging rapid expansion.

The scheme began to unravel on April 9 when CBEX abruptly restricted withdrawals before going offline entirely. In a final message, the platform urged users to deposit more funds to regain access to their accounts — a move seen as a last-ditch attempt to steal additional money.

In Nigeria, the Economic and Financial Crimes Commission (EFCC) has launched a multi-agency investigation with support from INTERPOL, targeting both local and foreign players behind the scam. The Securities and Exchange Commission (SEC) clarified that CBEX was never licensed and called its operations criminal under the new Investment and Securities Act.

Although CBEX falsely linked itself to a legitimate Chinese company of the same name, investigations have revealed no such affiliation.

Outraged investors in Lagos and Ibadan stormed CBEX offices, looting furniture and equipment. Authorities have since sealed the properties to maintain order.

Kenya was also hit, with victims reporting that their accounts and those of their friends were wiped clean over the weekend. Despite lacking a physical presence, CBEX gained traction in Kenya through aggressive social media marketing and peer endorsements. Reports show Kenya had the second-highest CBEX traffic in Africa. The Capital Markets Authority (CMA) had yet to comment by the time of reporting.

CBEX’s promise of high returns with minimal risk drew in thousands of users, many of whom staked their life savings. A combination of economic hardship and limited financial literacy helped the scam thrive.

Governments in both Nigeria and Kenya now face increased pressure to tighten regulation of digital assets without stifling innovation. In Kenya, the recently tabled Virtual Asset Service Providers’ Bill is expected to introduce tougher licensing and public education efforts to combat similar schemes.