Kenya and the International Monetary Fund (IMF) have agreed to start discussions on a new lending program after both sides decided to forgo the ninth review of the current 3.6 billion dollar loan arrangement.

The move comes as Kenya seeks continued financial support to stabilize its economy, following a sharp rise in debt-servicing costs due to years of extensive borrowing.

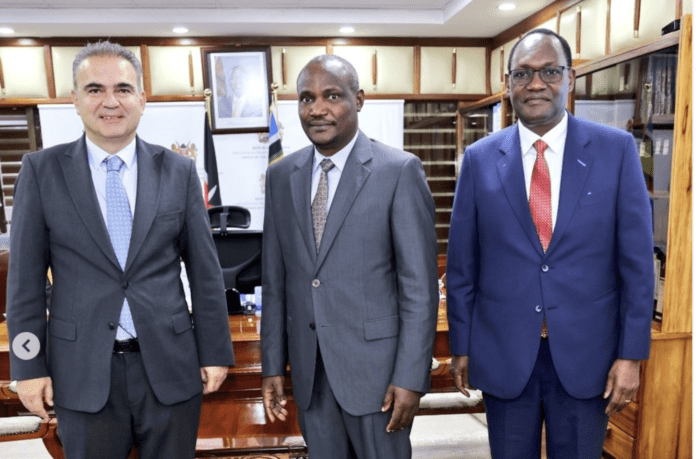

IMF Mission Chief Haimanot Teferra confirmed that Kenyan authorities and IMF staff reached an agreement to discontinue the ninth review of the Extended Fund Facility (EFF) and Extended Credit Facility (ECF) programs. She noted that Kenya has submitted a formal request for a new lending arrangement.

The current program, which began in April 2021, is set to expire next month. However, its implementation has faced setbacks, including anti-tax hike protests last year and controversy over Kenya’s new borrowing deal with the United Arab Emirates.

Kenya’s debt-to-GDP ratio stood at 65.7 percent as of June last year, surpassing the 55 percent threshold considered sustainable. The government has been exploring alternative financing options, including enhancing revenue collection, to manage its rising expenditure and mounting debt obligations.

By the end of last October, Kenya had received approximately 3.12 billion dollars under the current IMF program, according to IMF data.

National Treasury and Economic Planning Cabinet Secretary John Mbadi recently stated that the government is actively pursuing a new financing arrangement to support economic stability and fiscal reforms.

The talks with the IMF come at a crucial time as Kenya seeks to balance debt obligations while sustaining economic growth and development initiatives.