It is now illegal for microfinance companies to harass borrowers, following the enactment of the Business Laws (Amendment) Bill, 2024, which amended the Microfinance Act. The new regulations took effect on January 1, 2025.

The law explicitly prohibits non-deposit-taking microfinance lenders from harassing, abusing, or oppressing borrowers, guarantors, or any other individuals during debt collection. Practices such as threatening, using violence, or employing unlawful means to recover debts are now illegal.

Furthermore, lenders are barred from using obscene or profane language in communication with borrowers, guarantors, or others associated with debt recovery.

Under the new law, microfinance lenders are required to provide borrowers with accurate and clear information about loan terms, financial costs, and recovery procedures.

They must also maintain strict borrower confidentiality and ensure fair practices throughout the lending and recovery processes.

The law addresses widespread concerns about unethical debt collection practices by some digital lenders, described as “cruel” by borrowers. Many defaulters, even those late by a single day, have reported receiving threatening messages from lenders.

The Business Laws (Amendment) Bill, 2024, also expands the Central Bank of Kenya’s (CBK) regulatory authority to include non-deposit-taking credit providers such as digital lenders, peer-to-peer lenders, and credit guarantee businesses.

This regulatory shift is intended to promote fair practices, financial stability, and enhanced consumer protection through licensing, credit information sharing, and stricter oversight. Non-deposit-taking microfinance businesses will now fall under the CBK Act, transferring their oversight from the Microfinance Act.

The new framework introduces stringent transparency requirements, including mandatory disclosure of all credit costs and borrower rights.

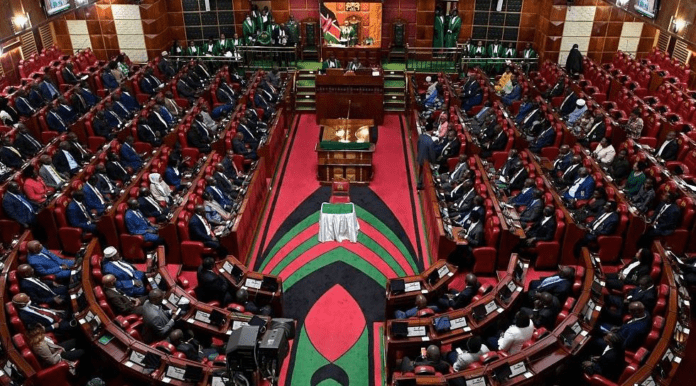

The Bill, sponsored by Majority Leader Hon. Kimani Ichung’wah, amends nine Acts of Parliament to enhance regulatory oversight, streamline processes, and bolster economic stability.

The proposed amendments of the Business Laws (Amendment) Bill, 2024 affect the Banking Act, Central Bank Act, Microfinance Act, Standards Act, Kenya Accreditation Service Act, Scrap Metal Act, Special Economic Zones Act, Kenya Industrial Research and Development Institute Act, and the National Electronic Single Window System Act.